开云体育全站App

开云体育在线入口全球首家一体化娱乐原生APP,尽显流畅,完美操作

开云体育App

开云电子整合热门竞猜项目,开云网站收录各地赛事盘路,让球、大小、总入球、单双、波胆与连串过关一应俱全,动画直播助您轻松跟赛。

开云棋牌App

开云电子依托官方直营体系运行,开云官网采用欧洲级安全认证标准,热门棋牌类型齐备,配合舒缓音乐,带来更沉浸更顺滑的体验,尽在开云棋牌。

登录器

开云体育在线观看可借助安全登录器直连入口,开云网站通过官方校验降低仿冒风险,支持Windows/MAC/Android,安装即用,体验更顺畅。

开云平台简介

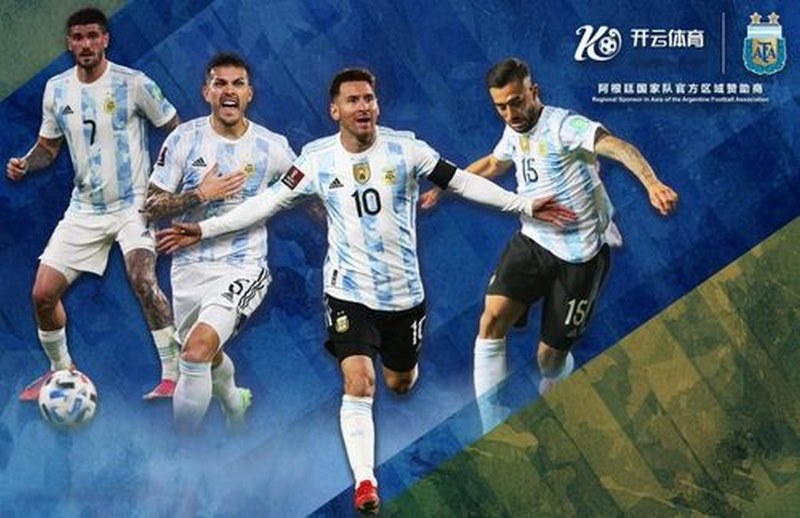

开云体育(KAIYUN SPORTS),中文简名为“ 开云”,英文简名为为“ KY SPORTS”,定位为华语市场体育与娱乐综合服务品牌之一,2022年成立并在国内运营,业务包含体育赛事、足球彩票、棋牌游戏、彩票购彩、电竞直播与线上娱乐节目,并通过开云平台与开云官网提供统一入口与稳定服务体验。

公司规模:1100-1200员工与千万会员。开云加入RGA与英国政府博彩协会并取得BVI执照认证,同时加入BMM国际检测体系;在国际监督下持续监测安全与公平,开云体育官网中国合规体系持续提升。

开云体育延伸至体育基金、体育版权、科技研发、信息安全大数据与云安全支付系统;依托奥运会、欧洲杯、2022年世界杯等赛事经验,并通过球队赞助与整合营销构建运营能力。平台采用云加密支付与256位加密技术,并通过ISO/IEC 27001:2013认证,保障开云体育官方登录与数据安全。

开云体育与PG电子、PP电子、MG电子、Playtech、IM电子、AsiaGaming、高登棋牌等合作,持续丰富开云电子与棋牌内容矩阵,提升整体可玩性。

开云以高可信与稳定服务获得用户广泛认同,签约因扎吉为品牌代言,并以【创新、执着、大爱、传承、挑战、超越】作为精神内核;持续投入公益,形成良好社会口碑。

开云官网月均提供约50000场滚球赛事,体育玩法超过2000种,支持零时差无缝滚球体验。独家安全机制与严密管理体系保障用户信息;并提供数据、技术与渠道支持,开云体育在线官网资源更全面。

全年365天,开云提供7×24小时咨询服务,科技团队持续优化产品与链路稳定性,覆盖开云体育登陆入口、开云体育在线入口、开云体育在线登入等关键通道。

开云体育在线入口企业策略及目标

开云集团致力以非接触式智能卡与多场景电子支付系统提升支付体验,让消费者与小微企业共享技术与可持续价值,并为澳门及大湾区金融科技和智慧城市转型持续贡献;依托开云官网加强基础设施与平台能力,支持大湾区及其他地区金融服务数字化升级,未来开云体育在线官网将继续迭代自有系统平台,凭借运营与技术专长携手亚洲领先伙伴战略协作,实现业务全球化。

开云体育在线入口常见的用户问题

在开云体育在线观看过程中若出现画面或功能相关问题,可参考常见问题汇总进行排查。

-

开云体育中国官方页面显示语言异常或乱码,如何调整编码与系统语言解决?

开云中国围绕用户体验优化入口与加载速度,电子与真人内容齐全,适合不同喜好;从开云体育在线入口进入后,可快速找到活动中心与热门专区,提升娱乐效率。

-

开云体育中国官方的公告与规则在哪里查看更完整,怎样避免错过重要变更?

开云平台主打稳定与多样化玩法,电子、真人、棋牌等内容覆盖广,界面简洁易用;玩家通过开云体育官方下载相关通道完成安装后,可随时进入游戏大厅,获得更顺畅的操作与更快的加载体验。

-

开云真人体育娱乐的入口在哪里更安全可靠,如何避免误入相似页面导致风险?

开云中国深耕华语用户需求,重点优化游戏大厅的稳定性与交互细节,电子与真人玩法选择丰富,适合不同偏好;通过开云体育登陆入口进入后,可快速切换专区并参与限时活动,整体体验更便捷、更沉浸。

-

开云体育中国官方出现账号安全提醒时,如何快速完成验证并加强账户保护?

开云官网提供电子与真人双重娱乐体验,推荐逻辑清晰、活动更新及时,更适合长期体验;用户通过开云体育官方在线进入即可快速切换内容板块,减少等待更畅快。

-

开云集团的品牌合作与赞助信息在哪里可以查看到官方说明,如何避免被虚假宣传误导?

开云平台强调多端适配与稳定访问,电子与真人玩法齐全,推荐与榜单更易发现新内容;用户通过开云体育在线官网进入即可高效开玩,娱乐更省心。

开云体育在线入口APP

开云体育在线官网独家原生APP支持全部移动端

开云体育热门游戏

你想要的开云平台都有,带给您丰富的游戏体检

开云体育

KAIYUN SPORTS

开云官网打造高品质体育场馆体验,赔率更具优势、操作更流畅;体育竞猜讲究清晰观赛,开云体育官方在线提供更全更高清的赛事视频覆盖,助力用户留存与互动。

玩法类型丰富,支持提前兑现,回款也能更快一步;从需求出发,让你投你所爱更轻松。

高赔率覆盖世界赛事,让球、大小、半全场、波胆、单双、总进球、串关等玩法齐备;配合动画直播与视频直播,边聊边投更尽兴。

开云真人

KAIYUN CASINO

开云真人视讯作为开云集团官方直营品牌,真人荷官在线互动带来更真实氛围,涵盖百家乐、骰宝、轮盘、牛牛、炸金花等多款真人视讯游戏;遵循国际标准与公平原则,开云平台打造互动直播平台,玩家可边游戏边欣赏主播表演并参与互动内容。桌台包含:百家乐、竞咪、龙虎、骰宝、轮盘等多种玩法。

我们坚持提供高品质真人馆,画面细腻、机制透明;用信任赢市场,用口碑赢用户长期信赖。

开云棋牌

KAIYUN BOARD

开云官方网站入口提供官方直营棋牌服务,欧洲顶级安全认证体系全程护航,棋牌品类丰富;在悦耳音乐与精致画面中畅玩热门玩法,感受非同凡响的极致体验,尽在开云棋牌。

覆盖市面热门游戏类型,选择全面多元,应有尽有不怕无聊;抢庄牛牛、龙虎斗等棋牌随心切换,好友对战竞技更有氛围。高清画质与流畅体验,助你树立口碑,打造精品平台。

开云电竞

KAIYUN ESPORTS

开云体育登陆入口推出创新电竞竞猜体系,支持时时滚球与自由串关;注单秒确认、热门赛事秒结算,独家滚球助你嗨翻全场。界面设计炫酷直观,体验顺滑清晰,盘口信息一目了然,新手也能轻松投注;覆盖所有大型赛事,每月百场比赛与上万盘口可期待。

开云电竞作为行业头部电竞赛事平台合作伙伴,提供最新最热门赛事竞猜,同时提供电竞视频与最新资讯,帮助提升热度与影响力。

开云彩票

KAIYUN LOTTERY

开云彩票依托开云真人体育娱乐生态,提供便捷丰富的彩票新玩法与沉浸交互体验,连线开奖更及时,彩种覆盖更广,开启彩票新纪元,尽在“开云彩票”。

超百种彩票玩法任您赢,开云为全球彩民提供多元内容,致力打造高品质娱乐环境与安心游戏空间,只为公平、公正开奖。

彩种更全、奖源更稳、玩法更丰富、开奖更快更稳,是拉新引流的强力工具;并提供自研彩票,助力平台实力更突出。

开云电游

KAIYUN SLOT

AG捕鱼、PG电子等一直是市场高热供应商,开云平台联合多家厂商强强联手,助您更快速打造专属电子游艺平台,百余款游戏任用户自由选择。

开云电子涵盖经典老虎机、刮刮乐、棋牌、街机等玩法,更多免费游戏与爆分大奖持续放送,等你来冲。

平均存款时间

合作支付平台

平均取款时间

合作游戏平台

开云体育活动

这里有很多开云的企业文化,品牌历史和经营策略,带你走进开云

开云体育在线观看直播间互动功能升级体验更热闹

开云中国多线路策略让访问更稳,尤其在高峰期更不易卡顿;配合开云体育在线入口的智能切线,遇到拥堵可快速调整。你可以把更多时间放在内容体验上,而不是反复刷新;帮助中心也更完善,常见问题处理步骤清晰可循。

开云体育官网登录异常解决方案合集验证码收不到也能处理

开云体育官网中国优化结构与兼容性,移动端滑动更顺、定位更快;搭配开云真人体育娱乐的互动体验,多玩法切换更连贯。你可以轻松进入常用桌台与热门区域,不被加载打断;画面细腻、节奏紧凑,更适合追求沉浸感的用户。

开云体育官方在线赛事更全直播更清晰玩法更丰富看球更带劲

开云官网把活动与任务节奏展示得更集中,优惠信息一目了然;同时开云网站采用轻量化布局,打开更快、滑动更顺。你能在更短时间定位到热门专区与当期主题,减少跳转与等待;对高频用户来说更友好,回访效率也更高。

开云官网页面优化加载更轻快内容结构更清晰更易阅读

开云网站轻量化设计降低加载压力,移动端浏览更顺;搭配开云体育在线入口的智能通道,高峰期也能保持稳定访问。你可以把常用入口收藏固定,减少重复查找;热点推荐更新快,适合碎片时间高频进入,也利于长期回访与持续探索。

开云体育登陆入口一键直达热门赛事专区看球下注更方便

开云体育中国官方同步权威公告与赛季热点,信息更可信;配合开云官方网站入口的安全识别与通道合集,访问更放心。你能快速锁定正规入口与常用模块,减少误入风险;提示清楚、步骤明确,新用户也能更快建立信任并持续使用。

开云体育入口官网活动中心升级优惠领取路径更短更好找

开云体育在线登入后可个性化设置界面与推荐偏好,使用效率更高;同时开云体育在线观看提供回放与集锦,追热点不受时间限制。赛前、赛中、赛后都有对应入口承接;操作更少,内容更集中,整体体验更完整且不易错过精彩。

开云体育中国官方精选赛事推荐榜让你每天都有好看好玩

开云体育在线登入后可启用订阅提醒与收藏,常看内容一键直达;配合开云体育在线观看的回放集锦,错过也能补看。赛前看情报、赛中跟进程、赛后补精彩,内容链条完整;体验更顺,减少来回切换与跳转。

开云体育官方在线赛事实时数据更快更新比分变化更及时

开云体育官网中国优化结构与兼容性,移动端滑动更顺、定位更快;搭配开云真人体育娱乐的互动体验,多玩法切换更连贯。你可以轻松进入常用桌台与热门区域,不被加载打断;画面细腻、节奏紧凑,更适合追求沉浸感的用户。

开云网站访问速度优化版支持多设备自适应浏览体验更清爽

开云真人体育娱乐更强调沉浸与互动,热门桌台切换顺滑;搭配开云体育官网中国的结构优化,查找更快更直观。你可以更轻松进入常用区域,体验过程中不被频繁打断;画面细腻、节奏紧凑,适合偏爱氛围与互动的用户。